Running a business means managing expenses, seizing opportunities, and—most importantly—lowering your tax burden when possible. One of the most powerful tools for doing that is the Section 179 tax deduction.

But what is it exactly? And how can small business owners use it to their advantage?

In this article, we’ll break down what is section 179 tax deduction, how it compares to other tax strategies, and how Simplicity Financial can help you track, report, and maximize your savings. From equipment purchases to vehicles, this deduction could be a game-changer for your business.

Looking to apply to Section 179 this year? Contact Simplicity Financial today for expert guidance 💼

What Is Section 179 Tax Deduction?

The Section 179 tax deduction allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is placed in service—rather than depreciating it over time.

According to the U.S. tax code, this tax deduction is intended to support small to mid-sized businesses by encouraging reinvestment in tools that help growth.

Instead of spreading depreciation out over multiple years, the section 179 deduction offers an immediate benefit, reducing your current tax liability and freeing up cash flow.

This deduction pairs well with smart financial planning. Our outsourced bookkeeping services help ensure all qualifying purchases are accurately tracked.

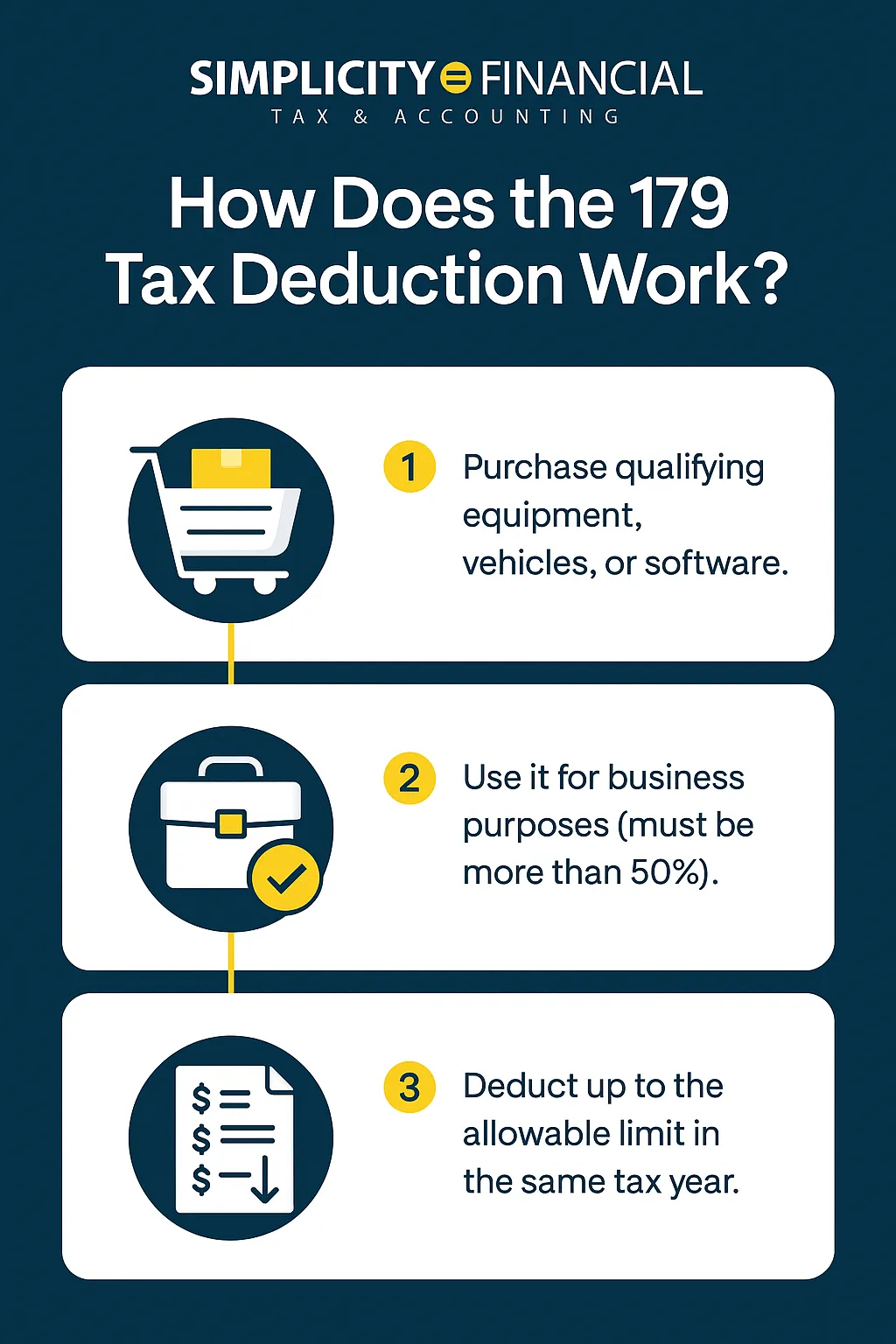

How Does the 179 Tax Deduction Work?

Here’s how the 179 tax deduction works in practice:

- Purchase qualifying equipment, vehicles, or software.

- Use it for business purposes (must be more than 50%).

- Deduct up to the allowable limit in the same tax year.

As of the current tax year, businesses can deduct up to $1,160,000, with a phase-out beginning at $2,890,000 in total purchases. These limits may change annually, so staying current is essential.

Need help calculating your eligibility? Our team offers tax preparation outsourcing to simplify your year-end filings.

What Qualifies for the Tax Deduction Section 179?

Eligible purchases include:

- Machinery and equipment

- Computers and office tech

- Business-use vehicles

- Software (off-the-shelf)

- Certain improvements to non-residential buildings

To qualify, property must be purchased (not leased), used primarily for business, and placed into service during the current tax year.

Wondering what doesn’t qualify? Land, inventory, and property used for lodging typically fall outside the limits of section 179 tax deductions.

If you’re unsure how to classify your business assets, Simplicity Financial can help you build a long-term strategy with our fractional CFO services.

SEE ALSO: What Is a SALT Tax Deduction? Guide for Business Owners

Section 179 Tax Deduction for Vehicles

One of the most searched variations of this topic is: Section 179 tax deduction for vehicles—and for good reason.

Qualifying business-use vehicles may be eligible for partial or full deductions depending on their weight and use. Here’s a quick breakdown:

- Passenger Vehicles (under 6,000 lbs): Limited to $11,160

- SUVs and Crossovers (over 6,000 lbs): Limited to $28,900

- Heavy Trucks/Vans: May qualify for the full 179 tax write off

To claim this correctly, documentation is key. Simplicity Financial’s remote bookkeeping ensures your mileage logs, purchase records, and asset use reports are always audit-ready.

Is There a 179 Tax Credit?

Technically, no—the 179 section deduction is a deduction, not a tax credit. That means it reduces your taxable income, not your actual tax owed dollar-for-dollar (as a credit would).

However, pairing this deduction with other strategies—like bonus depreciation or credits for energy-efficient equipment—can multiply your savings. Learn how it fits in with other write-offs like those discussed in our 529 tax deduction and Form 8863 guides.

Sec 179 Deduction vs. Bonus Depreciation

The sec 179 deduction is often compared to bonus depreciation—but the two serve different strategic purposes.

| Feature | Section 179 | Bonus Depreciation |

| Limit | $1,160,000 (2023) | No cap (100% through 2022, phased after) |

| Use | Can choose assets | Must apply to all qualifying assets |

| Flexibility | High | Low |

| Best for | Small to mid-sized businesses | Large capital investments |

A blended strategy may be best. We help businesses tailor the right approach through custom year-end tax planning.

When Should You Use the 179 Tax Write Off?

You should consider the 179 tax write off when:

- You’ve had a profitable year and want to reduce taxable income

- You’ve made substantial business purchases

- You prefer immediate deductions over long-term depreciation

- You want to offset the cost of upgrades or fleet expansion

Timing matters—if your equipment isn’t placed in service before the end of the year, you won’t be able to claim it. We can help you align your asset management and tax calendar effectively.

Other Tax Deductions to Keep in Mind

Simplicity Financial offers a wide range of tax support beyond Section 179. Explore some of our other guides to expand your deduction strategy:

- Are property taxes deductible

- Can you claim moving expenses on taxes

- Are legal fees tax deductible

- Can you write off a storage unit on taxes

- Do farms pay property taxes

- Silicon Valley power rebates

Curious if your purchases qualify? Talk to Simplicity Financial about how Section 179 can work for you 💼

Frequently Asked Questions About Section 179 Tax Deduction

What is Section 179 tax deduction used for?

It allows businesses to deduct the full cost of qualifying assets in the same tax year they are placed into service, rather than depreciating over time.

What qualifies for the Section 179 deduction?

Items like machinery, office furniture, business vehicles, and some software qualify—so long as they are used more than 50% for business purposes.

Can I claim a Section 179 tax deduction for vehicles?

Yes, if the vehicle is used for business. Deduction limits vary based on weight and classification. SUVs and trucks over 6,000 lbs may qualify for larger deductions.

Is the 179 tax deduction the same as a tax credit?

No, it’s a deduction that reduces your taxable income—not a credit that reduces your tax bill directly.

Can I combine Section 179 with other deductions?

Yes. You may combine it with bonus depreciation, operating expenses, or other small business tax strategies.

Where is Simplicity Financial located?

We’re based in California and serve clients remotely across the U.S. Visit Simplicity Financial or explore our blog for more tips.

Disclaimer: This article is intended for informational purposes only. Please consult with a licensed tax professional or the IRS to determine eligibility for Section 179 deductions or any related tax strategies.