When a child has investment income, the tax rules can shift fast. The goal of form 8615 is simple: it calculates the “kiddie tax” so certain unearned income is taxed in a way that prevents families from moving investments into a child’s name just to reduce taxes. That might sound abstract until a parent opens a brokerage 1099 and realizes the child’s return is suddenly more complicated than expected.

Many families prefer to get ahead of it with a quick review from Simplicity Financial before filing. A short check-in can confirm whether tax form 8615 applies and what information is needed to file cleanly. For help with the decision and the math, business owners and families can start here 😊: contact the team.

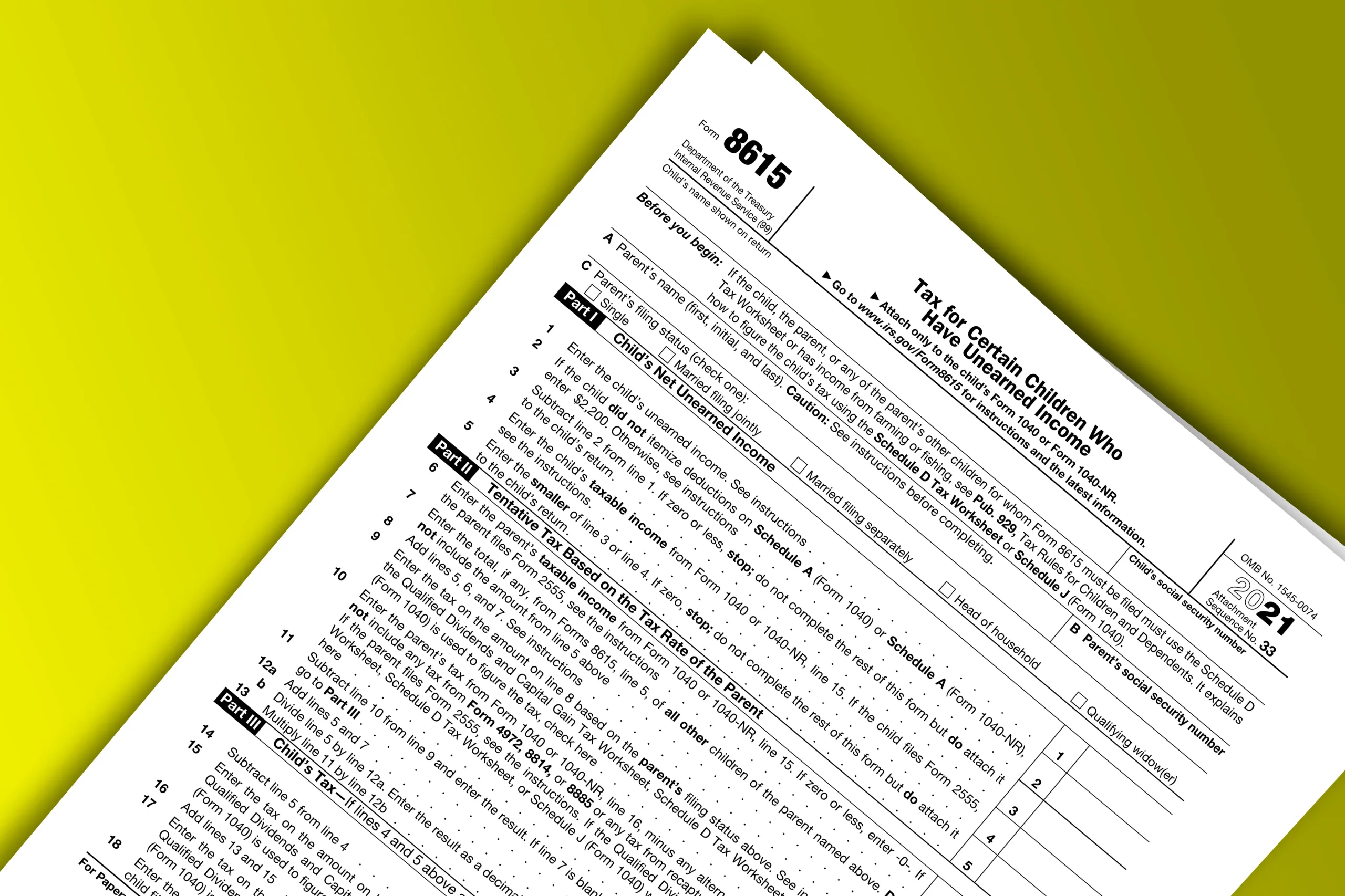

The IRS instructions make one key idea crystal clear: the child’s tax calculation may rely on the parent’s taxable income. In the official IRS instructions, line guidance notes that a filer may need the parent’s return amount to complete the calculation.

What Is Form 8615 and Why It Exists

If someone is asking “what is form 8615,” they are usually trying to answer one question: “Does my child’s investment income get taxed at my rate?”

In plain language, form 8615 is used to calculate tax on a child’s unearned income above a threshold, when the child meets certain age and support rules. The IRS explains that the form is used when a child’s unearned income is more than a set amount and the child meets age-related conditions (including certain 18-year-olds and full-time students under 24 in specific situations).

This matters because “unearned income” can include interest, dividends, and capital gains. When those amounts rise above the threshold, form 8615 can turn a “simple dependent return” into a return that requires information from both the child and the parent.

Who Has to File Form 8615

Families often assume the parent files it. Typically, the form is attached to the child’s return, not the parent’s return. The most practical way to think about it is this: the child files the return, but the parent’s tax information may be needed to compute the child’s tax.

The IRS outlines the general conditions under which tax form 8615 is required, including:

- The child’s unearned income is over the threshold for the tax year

- The child meets the age and earned-income support tests described by the IRS

- The child is required to file a return

Because these rules depend on the tax year and the child’s facts, it helps to read the filing triggers carefully, then confirm whether the child’s return can remain straightforward or needs form 8615 instructions applied line-by-line.

What Counts as Unearned Income for Form 8615

The kiddie tax conversation usually starts with investment accounts, but the definition of unearned income can be broader than expected. Common examples include:

- Interest

- Ordinary dividends and qualified dividends

- Capital gain distributions

- Net capital gains from sales

- Certain trust distributions

This is where families often stumble. A child can have only a small amount of earned income, yet still need form 8615 if unearned income crosses the threshold and the other conditions are met.

If a family is also trying to understand how these amounts show up on a return, the guide on how to read tax returns can help connect “forms and lines” to what is actually happening financially.

Form 8615 Instructions in Real Life: What Families Should Gather First

The best way to reduce stress is to collect the right inputs before touching the form. In most cases, instructions for form 8615 are easier to follow when these items are already in hand:

- The child’s income documents (brokerage forms, bank interest statements, any relevant 1099s)

- The child’s filing status and dependency details

- The parent’s return details that the form requires (often taxable income figures)

- Any tax worksheets the family used on the parent’s return (if applicable)

This prep work matters because form 8615 instructions don’t exist in a vacuum. They connect the child’s return to parent-level numbers, which means missing a single figure can cause rework later.

Tax Form 8615 and the Parent Return Connection

People searching “tax form 8615” are usually surprised by one thing: the calculation can depend on the parent’s taxable income.

That doesn’t mean the child’s income gets added to the parent’s return. It means the child’s tax on a portion of unearned income may be computed using the parent’s information.

This is also why strong documentation habits help. When parent and child tax details must line up, clean recordkeeping prevents last-minute scrambles. For households that track multiple accounts or dependents, outsourced bookkeeping services can make it easier to keep financial records organized throughout the year, instead of reconstructing everything during tax season.

Form 8615 Line 6 Explained Without the Headache

One of the most searched pain points is form 8615 line 6, because it’s where the parent’s taxable income often comes into play.

The IRS instructions for the current filing year provide specific direction for line 6, including where to pull the parent’s taxable income from on the parent’s return and what to do if the amount is zero or less.

This is the moment where families sometimes realize they cannot finish the child’s return without the parent’s return details being final. If the parent’s return is still in progress, it can delay the child’s filing.

A practical approach is to prepare both returns in a coordinated way so the numbers land correctly the first time.

Form 8615 Instructions: A Simple Step-by-Step Flow

The full form 8615 instructions can feel dense, so here is the practical flow most families follow:

1) Confirm the Filing Trigger

Check whether the child’s unearned income and age/support tests point to form 8615 being required.

2) Separate Earned vs Unearned Income

Make sure wages are not being mixed with investment income. This keeps the form logic clean.

3) Gather Parent Return Inputs

This is where the parent’s taxable income and other relevant amounts matter, especially for lines tied to the parent’s bracket.

4) Complete the Form and Attach It

Tax form 8615 is generally attached to the child’s return.

5) Review for Timing Issues

If the parent’s return changes, it can ripple into the child’s form.

Families who want support with that end-to-end flow often prefer working with a team that can manage the details and reduce the back-and-forth. Tax preparation outsourcing can be a fit when a household has multiple filings, multiple dependents, or time constraints that make accuracy and speed equally important.

When Form 8615 Becomes a “Family Coordination” Problem

A common story looks like this:

A teen has a custodial account. There’s a dividend reinvestment program. The market had a good year. Nobody thinks much of it until the tax forms arrive. Suddenly, the child’s return needs form 8615, and the parent’s return is not finished because one last K-1 is missing.

That is why planning matters more than perfection. When a family knows what is form 8615 and understands the dependencies early, they can prevent a filing logjam.

If a family also wants to estimate what the added complexity might cost, the article on average cost of tax preparation by CPA can help set expectations around tax prep pricing factors before committing to a path.

How Form 8615 Impacts Credits and Other Forms

Families sometimes worry that form 8615 changes everything on the parent return. Typically, the form is a child-return calculation tool, but it can influence the overall household filing plan.

It also helps to remember that many families have multiple forms interacting at once. When reviewing a child’s return and the parent’s return together, items like credits and additional taxes can become relevant. For broader context on how “extra items” attach to Form 1040, this overview of Schedule 3 (Form 1040) can be a helpful companion reference.

Form 8615 Instructions and Filing Logistics

Tax filing is not only about math. It’s also about logistics, especially when multiple returns need signatures, attachments, and mailing plans.

If a family is filing by mail or managing multiple paper documents, it is worth keeping the filing package neat and trackable. This guide on the tax return envelope explains what to consider so documents arrive safely and the filing experience is less stressful.

Form 8615: Next Steps With Simplicity Financial

Form 8615 is one of those tax forms that feels small until it isn’t. It often shows up when a child’s unearned income grows past the threshold and the household needs to coordinate parent and child filing details. When families understand form 8615 instructions early, they can avoid the last-minute scramble for parent taxable income, reduce rework, and file with confidence.

For families who want a clear answer on whether tax form 8615 applies, plus help completing instructions for form 8615 correctly the first time, Simplicity Financial’s tax team can review the situation, coordinate the required inputs, and support a smoother filing outcome 😊

Frequently Asked Questions About Form 8615

What Is Form 8615 Used For

What is form 8615 used for? It is generally used to figure the child’s tax on unearned income above the threshold when the IRS age and support rules apply.

Where Can Families Find Form 8615 Instructions

The most reliable form 8615 instructions are the official IRS instructions, which explain who must file and how to complete key lines, including parent-return references.

Is Tax Form 8615 Filed With the Parent Return

Tax form 8615 is generally attached to the child’s return, not filed as part of the parent’s return, even though parent information may be needed to calculate the tax.

What Are Instructions for Form 8615 When the Parent Return Is Not Finished Yet

When the parent return is not final, families often need to pause because instructions for form 8615 can require parent taxable income details. Coordinating the filing order can prevent having to revise the child’s return later.

Why Does Form 8615 Line 6 Matter So Much

Form 8615 line 6 is a common sticking point because it typically pulls a specific amount from the parent’s return, and the IRS instructions provide direct guidance on what to enter and where it comes from.

How Should Families Prepare Before Following Form 8615 Instructions

Before completing form 8615 instructions, families should gather the child’s unearned income documents and confirm the parent return amounts needed for the calculation. This reduces mistakes and rework.

Who Can Help With Form 8615 If It Feels Confusing

If a family wants support determining whether form 8615 applies and completing it accurately, a qualified tax professional can help coordinate the parent and child returns. For direct guidance, Simplicity Financial can help families work through the requirements and file with clarity.

Disclaimer

This article is for general informational purposes only and does not constitute tax, legal, or accounting advice. Readers should consult a qualified accountant or tax professional for guidance tailored to their situation, or check with local tax authorities for the most accurate and up-to-date information.