Picking the best state to start an LLC sounds like a one-time checkbox. In real life, it’s a decision that can follow a business for years through fees, filings, and “wait, why do we have to register again?” surprises. The professional answer is not “Delaware” or “Wyoming” on autopilot. The best answer is the one that fits where the business truly operates, where the owners live, and what the next 12 months look like.

For business owners who want a quick, practical recommendation based on real facts, Simplicity Financial helps clients across the U.S. remotely. If you want the shortest path to a clear decision, share your footprint through the contact page. A few details are usually enough: where the owner lives, whether there are employees, where inventory sits (if any), and whether the business is local or online.

Now, here’s the core idea that drives most outcomes: you can form an LLC in one state, but if you operate in another state, you may still need to register there too. The U.S. Small Business Administration explains that businesses often must register in states where they conduct business, and an out-of-state LLC may need “foreign qualification” in the operating state. That process can come with additional paperwork and fees. The SBA’s overview is here under SBA.

Best State to Start an LLC: What “Best” Really Means

When someone searches what is the best state to start an LLC, they usually mean one of these three things:

- Lowest total cost over time

Not just the formation fee. The total cost includes annual reports, renewal fees, registered agent costs, and the administrative load that can quietly eat your time. - Cleanest compliance path

A structure that doesn’t force you into filing in multiple states unless your business actually needs it. - A state choice that supports the business plan

Hiring, raising money, adding partners, storing inventory, selling into new states, or opening a second location can change what “best” looks like.

This is also where many owners benefit from separating the legal structure from the tax story. An LLC is a legal entity type under state law. Tax treatment is a separate layer. If you’re still sorting out the language and what it implies, this explainer clears up the common confusion: Is an LLC incorporated or unincorporated.

Choosing a State for Your LLC: Start With Where the Business Actually Lives

For most small businesses, the best state to start an LLC in USA is simply the state where the business is managed and where the work actually happens. That’s not a boring answer. It’s a cost-control answer.

Example: A local business

A photographer in Arizona forms an LLC in Nevada because someone said it’s cheaper. The photographer still shoots in Arizona, meets clients in Arizona, and markets locally in Arizona. In many real-world scenarios, this turns into Nevada plus Arizona compliance. The “cheap filing” becomes “two states to track.”

Example: A remote service business

A consultant who lives and works from Illinois forms an LLC in Delaware, but all work is performed from Illinois. The consultant may still need to register where the business operates. The owner now tracks multiple deadlines for no operational benefit.

Example: A multi-state business

A company with employees in two states and inventory stored with a fulfillment partner in a third state might have legitimate reasons to think beyond “just form where you live.” But that decision should be made with a footprint map, not a listicle.

If you want a plain-language starting point before you even pick a state, this page is a good first step: Should I incorporate myself.

A CPA “Footprint Map” You Can Do in 5 Minutes

If you’re asking which state is the best to start an LLC or what state is best to start an LLC, don’t start with the states. Start with the footprint. A CPA will typically look at four areas because they predict where compliance will follow.

1) Where is the business managed day-to-day?

If the owner runs the business from a home office in one state, that’s often the operational center.

2) Where do people work?

Employees and contractors can create obligations. If you have a virtual assistant in one state and a sales contractor in another, it’s worth understanding where the business has people-based activity.

3) Where is inventory stored or shipped from?

E-commerce owners often forget this one. Inventory stored with a third party can be a meaningful operational connection.

4) Where do you do recurring in-person work?

Regular on-site services, installations, or repeated travel to a state for business can matter.

Once you write those down, the phrase best states to start an LLC in usually stops being mysterious. The right choice becomes the one that matches reality and avoids duplicate compliance before your revenue needs it.

Best State to Start an LLC for Online Business: Selling Nationwide vs Operating Nationwide

This is the spot where people get tripped up, especially when they’re chasing best states for LLC advice online.

You can sell to customers across the U.S. without registering an LLC in every state. Customer locations alone are not the same thing as operational presence. In practice, what triggers extra state registrations is more often tied to people, inventory, and where the business is managed.

Example: A SaaS business run from one state

A software company sells subscriptions nationwide, but it’s managed from one home state, has no inventory, and no employees elsewhere. In many cases, the simplest compliance story is still forming where it’s managed and expanding only when operations truly expand.

Example: An e-commerce business using a fulfillment partner

An online store might live in one state but store goods with a fulfillment partner in another. That footprint can change the conversation. This is exactly why the best state to start an LLC for online business is not a one-size answer.

If your business is growing fast and the decision affects cash flow, payroll planning, or expansion timing, it can help to model the next steps. That’s where fractional CFO services can be useful, because it turns “which state should I pick?” into numbers, timelines, and a plan you can follow.

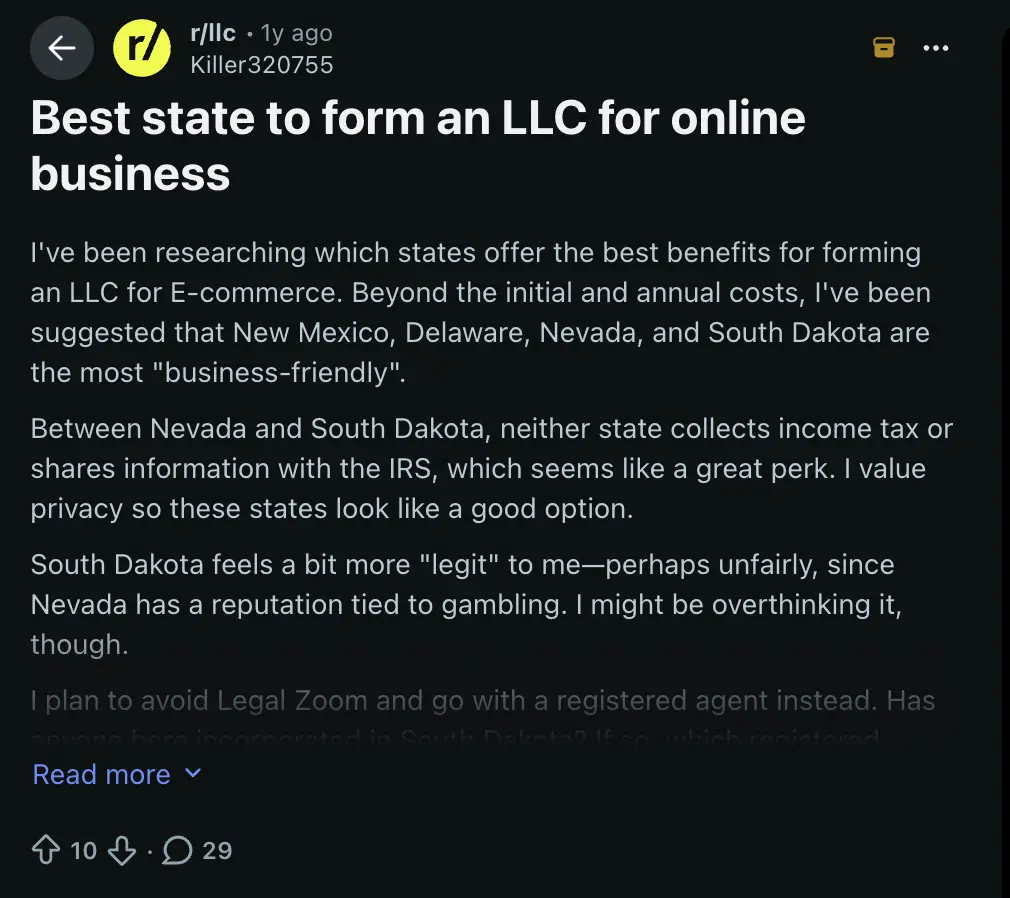

Browsing the Best State to Start an LLC Reddit Discussions

Search best state to start an LLC Reddit and you’ll see the same pattern: people compare states like New Mexico, Nevada, Wyoming, Delaware, and South Dakota, and they’re trying to optimize for fees, privacy, and simplicity.

In this discussion on Reddit, you’ll see recurring themes that are genuinely useful for business owners:

- People worry about paying twice if they form out of state and still have to register at home

- Commenters push back on “internet picks,” especially when the owner is operating from a specific home state

- The conversation quickly turns to the real question: “Where am I actually doing business?”

Here’s the CPA angle: Reddit is good at surfacing the right questions to ask. It is not designed to confirm your exact compliance obligations, because those depend on facts like where the owner lives, where work is performed, and where inventory and employees are located.

Best State to Start an LLC: The Cost Test That Prevents Regret

A lot of owners choose a state based on one attractive detail. A low filing fee. A “business-friendly” reputation. A tax headline. The regret shows up later when the compliance load becomes real.

Here’s a cleaner, more professional way to pressure-test the decision without turning it into a research project.

A CPA Cost Test for Forming Out of State

Step 1: List what you’re actually trying to gain

- Lower formation fee or lower annual fees

- A governance setup that matches investors or partners

- A structure that supports future expansion or a sale

Step 2: List what you’re adding to your compliance workload

- Registered agent requirements in a second state

- Annual reports or renewals in more than one state

- Additional state notices, deadlines, and recordkeeping

- Potential need to keep business addresses and filings consistent across states

Step 3: Estimate your “two-state total” for the next 12 months

Instead of comparing one state’s fee to another state’s fee, compare the full picture:

- the state you form in

- plus any state you must register in because that’s where you operate

This approach is more honest, and it’s usually where business owners realize why the best state to start an LLC is often the home operating state.

If you want help turning that checklist into a concrete plan and filing timeline, many owners lean on tax preparation outsourcing to keep the structure aligned with what will actually be filed, and when.

When Starting an LLC in USA, Bookkeeping Matters More Than People Expect

State choice and tax compliance get harder when financial records are messy. Not because the state is “bad,” but because multi-state activity requires clearer tracking.

Here’s what “clean books” actually looks like in this context:

- Income is categorized consistently, so taxable income can be supported

- Owner draws and business expenses are separated, so returns don’t become a cleanup exercise

- Payroll or contractor payments are tracked cleanly if people are working in multiple states

- Inventory and COGS are handled correctly if you’re selling products across state lines

That’s why growing businesses often stabilize their systems first with outsourced bookkeeping services. It’s not about being perfect. It’s about having records that can support the structure you choose.

Best State to Start an LLC in USA: A Simple Decision Framework

If you want a short answer to best states to start an LLC in, use this framework:

- If the business is operated and managed in one state, start there

That is the most common “best” outcome for small businesses. - Form out of state only when you can explain the operational reason clearly

If the reason is governance, investors, or real multi-state operations, it may make sense. If the reason is a vague tax headline, it often doesn’t. - Assume your operating state still matters

Because it usually does, especially when the business is managed there.

If you want the “apply this to my exact situation” answer, reach out through the contact page. A CPA can usually confirm whether an out-of-state formation reduces your total burden or creates two sets of obligations.

Frequently Asked Questions About Best State to Start an LLC

What Is the Best State to Start an LLC In for a Local Business?

For most local businesses, the best state to start an LLC is the state where the business is actually operated and managed, because forming elsewhere often leads to additional registration requirements.

Best State to Start an LLC in USA: Is There One “Best” State for Everyone?

No. The best state to start an LLC in USA depends on where the owner lives, where the business is managed, and whether there are employees, inventory, or recurring activity in other states.

Which State Is the Best to Start an LLC If I Want the Lowest Fees?

The lowest fee state is not always the lowest cost option. If you form in a low-fee state but still need to register where you operate, the “two-state total” can cost more than forming locally.

Best States to Start an LLC In: What Should Online Businesses Focus On?

Online businesses should focus on where the business is managed, where people work, and where inventory is stored. Those facts typically matter more than customer locations when deciding the best states to start an LLC in.

Best State to Start an LLC Reddit Advice: Should It Drive the Decision?

Reddit can help you spot common questions and pitfalls, especially around out-of-state formation. But it can’t replace a footprint-based decision, because your obligations depend on your specific operations and where they occur.

What Is the Best State to Start an LLC In If I Expect Fast Growth?

If you expect fast growth, the decision should support the next 12 months: hiring plans, inventory or fulfillment plans, potential partners or investors, and where the business will be managed. It often helps to confirm the plan before filing.

Disclaimer

This article is for general informational purposes only and does not constitute tax, legal, or financial advice. Tax outcomes depend on individual facts and circumstances, and tax rules may change. For advice tailored to your situation, consult a qualified CPA or tax professional and refer to official government guidance.