A parent overseas wires money for a down payment. A grandparent abroad leaves an inheritance. A family trust makes a distribution. Then someone searches form 3520 at 11:47 p.m., and the internet answers with sirens.

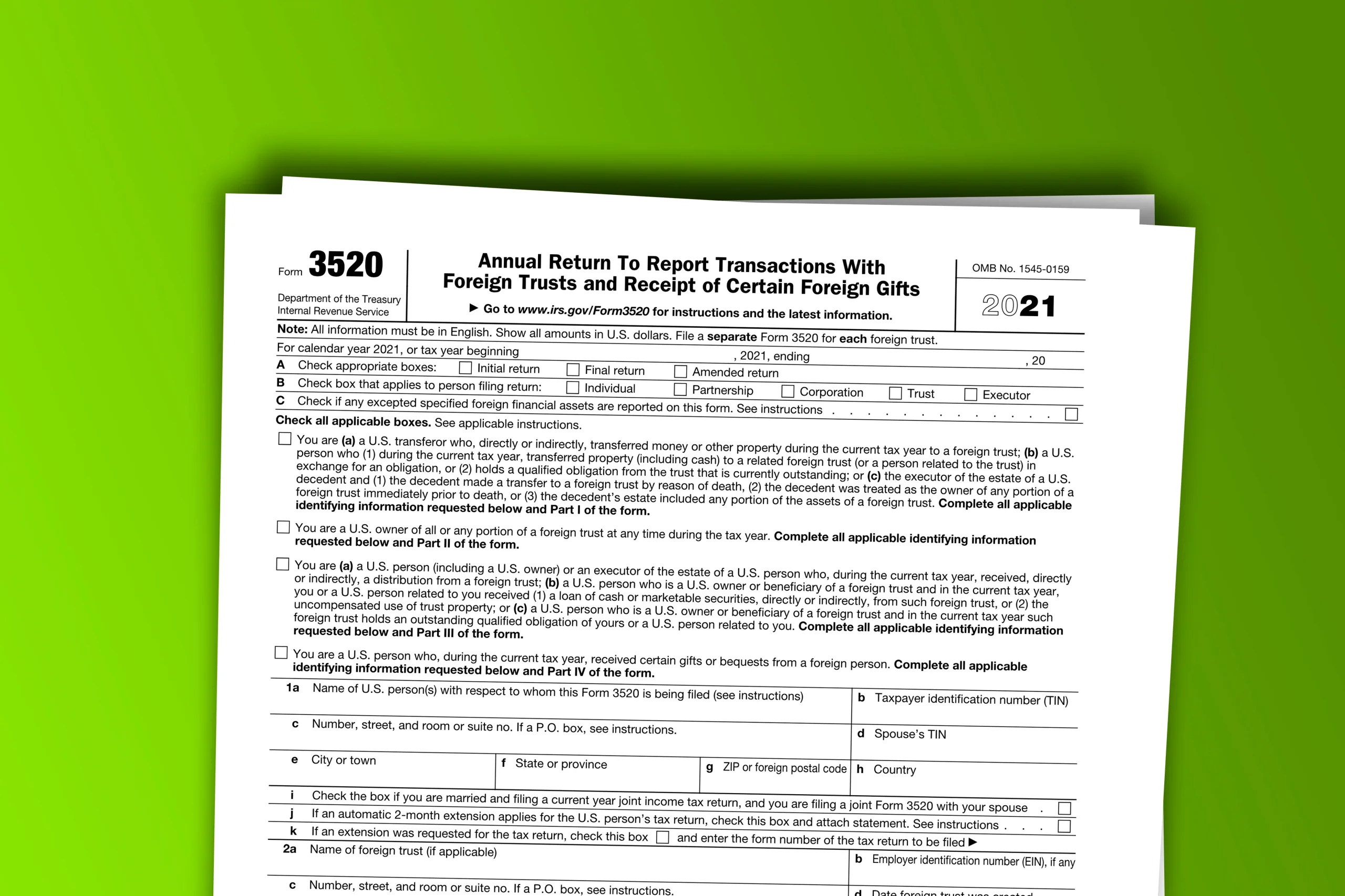

Here’s the calmer truth: form 3520 is an IRS information return for certain foreign gifts and foreign trust situations. It’s not a moral judgment, and it’s not automatically a tax bill. The goal is to confirm whether you have a filing requirement, collect the right documents, and submit a clean report.

For Americans who want expert help without office visits, Simplicity Financial supports clients remotely across the United States. If you want a fast “does this apply to me?” review, start with the secure intake on the contact page 😊

The best official overview is the IRS page about the form.

What Is Form 3520 and Why People Miss It

If you’re asking what is form 3520, you’re usually trying to answer one practical question: “Do I have to report this foreign gift or trust activity?”

In general, this filing is used by U.S. persons to report:

- Receipt of certain large foreign gifts or bequests

- Certain transactions with foreign trusts, including distributions

- Certain ownership situations involving foreign trusts

Many people miss it because the money doesn’t always feel like “income.” A family gift can look like help. A bequest can look like closure. A trust distribution can look like an ordinary transfer. Reporting rules can still apply depending on the facts.

If you want to understand how information returns fit into the bigger filing picture, read how to read tax returns for a plain-English walkthrough.

Form 3520 Instructions: Identify the Right Reporting Bucket First

Most form 3520 instructions get easier when your situation is sorted into the right bucket. Before you start filling lines, classify the event.

1) Large Foreign Gifts or Bequests Received

Use this bucket when a U.S. person receives a large gift or bequest from a foreign individual or foreign estate.

2) Foreign Trust Transactions

Use this bucket when there’s a distribution from a foreign trust or another reportable trust transaction.

3) Foreign Trust Ownership Rules

Use this bucket when a U.S. person is treated as an owner of a foreign trust under the applicable rules and must report.

If you’re unsure which bucket fits, pause and write the story in plain English first. A consistent narrative makes the rest of the steps much easier.

The 3520 Form Checklist: Documents to Gather Before You Start

A clean document packet prevents most of the stress. Use this checklist before you follow the step-by-step guidance. Think of it as your 3520 form prep kit.

Core Documents for Most Filings

- Bank or brokerage records showing the amount received

- Wire confirmation, deposit receipt, or settlement statement

- Sender identity details (legal name, relationship, country)

- Any trust letters or distribution statements if a trust is involved

- A one-page timeline describing what happened

One-Page Timeline Template

- Date received

- Amount received

- Who sent it

- What it was (gift, bequest, distribution)

- Why it was sent

- What documents support each item

If your records live in five different accounts and two different inboxes, consider building a repeatable system. For year-round organisation, outsourced bookkeeping services can help keep documentation consistent.

Form 3520 Example Scenarios That Match Real Life

A form 3520 example is often the fastest way to stop guessing. Below are common situations that trigger reporting questions.

Form 3520 Example 1: A Parent Abroad Helps With a Home Purchase

A U.S. taxpayer receives a large transfer from a parent outside the United States to help with a down payment. The key is documenting the source, the amount, and the date received.

Form 3520 Example 2: An Inheritance Arrives From a Foreign Estate

A U.S. person receives a bequest from a foreign estate. Even when the recipient thinks “inheritance is not income,” reporting can still be required depending on the details. Keeping estate-related records organised also helps in future years. See how long to keep tax returns after death for a practical retention approach.

Form 3520 Example 3: A Distribution Comes From a Foreign Trust

A beneficiary receives a distribution tied to a foreign trust. Trust situations often require clearer supporting paperwork because classification and reporting details can depend on trust statements, correspondence, and timelines.

If any form 3520 example feels close to your situation, the best next step is to confirm the bucket, gather documents, and file accurately.

Common Mistakes That Create Unnecessary Panic

Most problems come from avoidable missteps, not bad intentions.

The Most Common Mistakes

- Assuming “it was a gift” means “there’s nothing to file”

- Filing the main return and forgetting the required attachment

- Reporting amounts without keeping supporting records

- Mixing up foreign reporting forms and filing the wrong one

- Waiting until deadline week to learn the rules

- Writing inconsistent explanations across emails, notes, and documents

If “audit fear” is what’s driving the stress, it helps to understand what an audit is and what standard tax work is. This guide explains audit vs tax accounting in practical terms.

EPA Form 3520-1 vs IRS Form 3520

Search results can make this topic more confusing than it needs to be. epa form 3520-1 is not the same thing as this IRS reporting form.

- epa form 3520-1 relates to importing vehicles and engines into the United States.

- The IRS form in this article relates to reporting certain foreign gifts and foreign trust transactions.

If you searched epa form 3520-1 while dealing with an overseas gift or trust distribution, you likely took a wrong turn in Google. You can ignore the import form unless you are literally importing a vehicle.

Privacy Matters When Foreign Gifts Involve Family Money

Foreign gifts and trust distributions can involve sensitive family information. Privacy should be part of your workflow.

Practical privacy habits:

- Share only what’s needed to support reporting facts

- Use secure storage and clear file names for documents

- Keep one master timeline so the story stays consistent

- Avoid forwarding sensitive PDFs through casual threads

For readers who want context on privacy standards in financial services, the California Financial Information Privacy Act overview is a helpful reference point.

Form 3520 for Americans Filing Remotely: A Simple 5-Step Plan

This is a clean workflow for remote clients who want the process handled without chaos.

1) Confirm Whether the Filing Applies

Start with your bucket. Is it a foreign gift or bequest, a trust transaction, or a trust ownership reporting issue?

2) Build the Document Packet

Use the checklist above. Name files clearly so nothing gets lost.

3) Write the One-Page Timeline

This prevents contradictions and makes form 3520 instructions easier to follow.

4) Align the Story With the Main Return

A consistent story reduces rework and helps the filing hold up over time.

5) File and Store Records for Next Year

If the foreign relationship continues, build a system now so this isn’t a yearly surprise.

If you want the entire process handled end-to-end, tax preparation outsourcing can replace stress with a structured plan.

If you’re a business owner and the foreign activity connects to operations, cash flow, or long-range planning, fractional CFO services can help keep decisions organised and defensible.

For more plain-English tax topics, browse the Simplicity Financial blog.

Form 3520: Next Steps With Simplicity Financial

Form 3520 is stressful because it’s unfamiliar, not because it’s impossible. The fastest path to calm is to confirm whether it applies, organise the right documents, and file with a consistent narrative supported by records.

For Americans who want remote help applying form 3520 instructions, reviewing a form 3520 example against their situation, and avoiding preventable mistakes, the next step is a quick intake and document checklist on the contact page 😊

Frequently Asked Questions About Form 3520

What Is Form 3520 and Who Needs to File It

If you’re asking what is form 3520, the IRS summary explains that it’s used to report certain transactions with foreign trusts and receipt of certain large foreign gifts or bequests. Whether you must file depends on the facts and reporting category. See the IRS overview.

Where Can Taxpayers Find Form 3520 Instructions

The most reliable form 3520 instructions come from the IRS materials linked on the official page. Start there before relying on forum interpretations. See the IRS page.

Can You Share a Form 3520 Example That Is Common

A common form 3520 example is receiving a large gift from a parent living abroad to help with housing. Another is receiving a distribution connected to a foreign trust. The reporting decision depends on the details and documentation.

Why Are People Searching EPA Form 3520-1 With This Topic

People often see epa form 3520-1 in search results because the numbers overlap. The EPA form relates to vehicle and engine importation. It is not the IRS foreign gift and trust reporting form.

Is the 3520 Form a Tax Bill or a Reporting Form

In many cases, the 3520 form is an information return used for reporting, not a direct calculation of income tax owed. The purpose is disclosure of specific foreign gift and trust situations. See the IRS overview.

Where Can Americans Get Remote Help With Form 3520

Americans can work with a qualified tax professional who understands foreign gift and trust reporting and can review documents remotely. For support, Simplicity Financial can help clients across the U.S. with a structured process.

Disclaimer

This article is for general informational purposes only and does not constitute tax, legal, or accounting advice. Readers should consult a qualified accountant or tax professional for guidance tailored to their situation, or check with local tax authorities for the most accurate and up-to-date information.